We Are Your Financial Transformation Specialists

"Investing together for 20 years!"

Growth Syndicates Australia (GSA) has a dedicated team focused on transforming our clients financial position. We enable unique & exclusive investment opportunities for clients to achieve specific outcomes.

What Our Clients Achieve

- ✔︎ Eliminate Debt – consolidate debt and pay off the mortgage in around 5 years.

- ✔︎ Create Wealth – leverage existing and available funds to build a substantial financial future.

- ✔︎ Retire in Style – significantly enhance superannuation for an ideal retirement lifestyle.

The GSA Advantage

By registering you as an experienced investor within a wholesale fund (level above Off The Plan Investing & Retail Investing) you get to share in a higher rate of growth. Accessing this higher rate of growth enables you to achieve financial outcomes in shorter periods of time. Syndication investing allows you to invest less to achieve more without impacting your lifestyle.

Unique & Exclusive Opportunity

Exceptional investment growth - leveraging a larger property project for bigger profits. A suburb growing at 5% pa can achieve a substantially higher growth rate ... as an experienced investor in a wholesale fund, capital growth is one component, the other four components are significant.

Our Process Is Simple!

GSA takes care of the end to end process and beyond – it's a partnership

perm_phone_msg

Step 1

Your financial transformation starts with a telephone discussion.

insights

Step 2

We then provide you with a clear picture on what GSA achieves for clients & see where these results apply to you, with no charge or obligation.

flag_circle

Step 3

If you like who we are, we'll get started on your Financial Transformation together, at no charge!

Our History

We have a proven track record of outstanding financial success:

180+

Happy Clients

12

Advisory Groups

20%

Projected Annual Returns

$64M

Invested

Current Projects

Our 'blue chip' selection model ensures that we only invest in what we consider to be quality development sites situated favourably within established local and metropolitan infrastructure. We look for opportunities in well established, quality 'infill' locations, as well as high-growth areas of Melbourne. Suburbs such as Kew, Malvern and Brighton where the chance of capital growth is very high. This provides us with a good selection of investment opportunities to suit a variety of budgets and strategies.

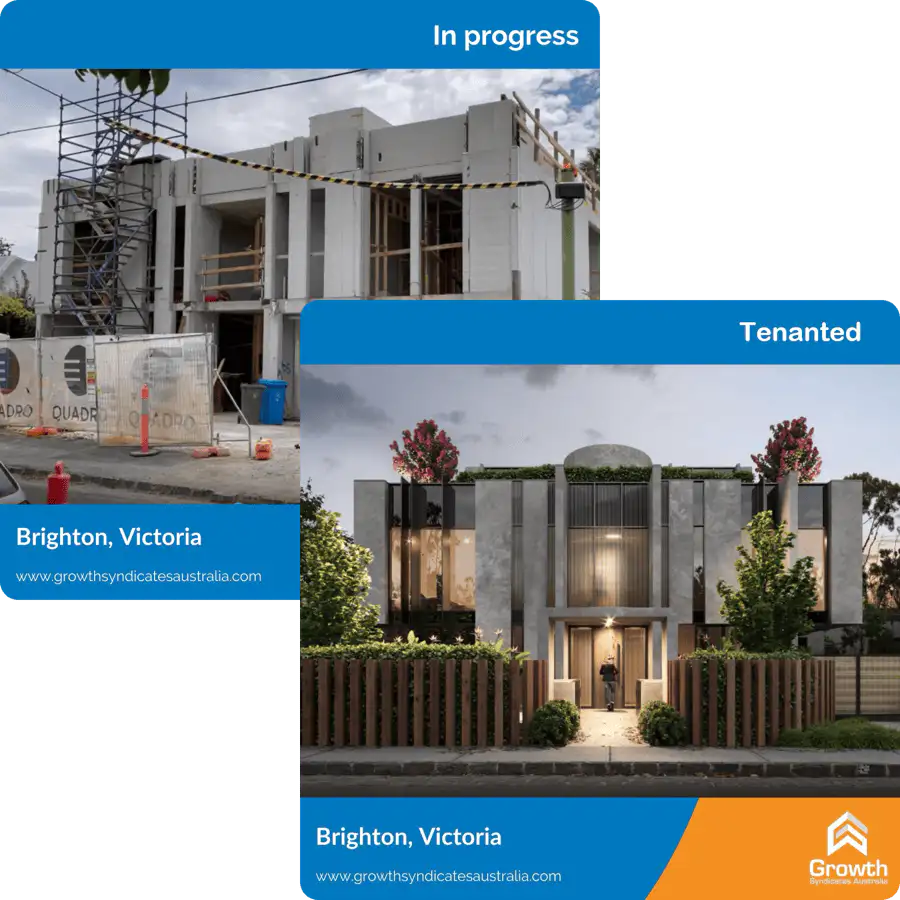

PROJECT NUMBER 8 BRIGHTON - VICTORIA

Melbourne's best suburb just got better! A boutique selection of five luxurious and contemporary residences in one of Melbourne's most affluent suburbs.

PROJECT NUMBER 9 MALVERN EAST - VICTORIA

A boutique collection of only 4 townhouse residences. With large courtyards and individual lifts from your secure basement parking, this is an attractive opportunity for growing families and down-sizers.